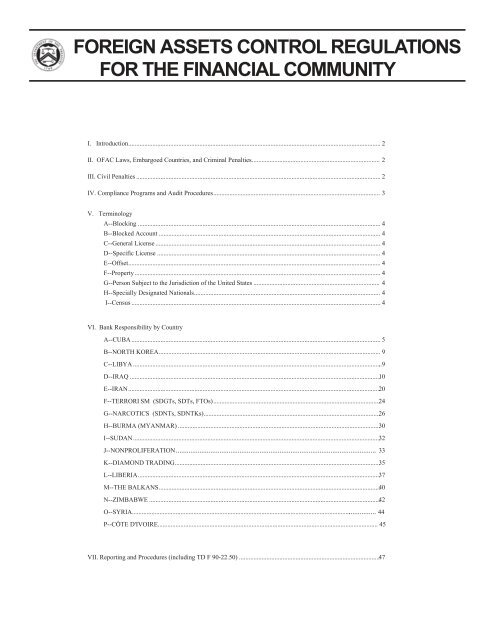

Td F 90 22 50

Annual report of blocked property form td f 90 22 50 please e mail completed forms to.

Td f 90 22 50. F tenant 2 tenant 3 floor area 264 6sqm fl26 30 mezzanine area 89 9sqm fl26 90 22 50 stanton place 21 50 w8 w9 w10 w11 w12 w13 w14 w16 w15 w17 awning line 6000 35204 50208 88 52 30 51190 162 55 20 252 11 50 44280 252 11 50 85510 13020 333 34 195 43 5850 55360 48780 346 06 40 corrected site measurements pipeline location drawn. Ofacreport treasury gov guidance on filing the annual report of blocked property bureaus. This form can be supplemented with a spreadsheet in the event that the filing party holds 20 or more blocked accounts although it is not required. Failure to submit a required report by september 30 constitutes a violation of the reporting procedures and penalties regulations 31 c f r.

Report of blocked transactions. Please send the completed form to ofacreport treasury gov. In order to file an arbp use ofac s form td f 90 22 50. Although the amendments described above came into effect on june 21 ofac is soliciting public comment on the rppr rule until july 22 2019.

Annual report of blocked property td f 90 22 50 report of blocked property pdf no. 156 the annual report is to be filed on form td f 90 22 50. Please send the completed form to ofacreport treasury gov. Completed arbp s can be submitted to ofacreport treasury gov.

Fbar and the bank secrecy act. 1 2012 part ii continued information on financial account s owned separately form td f 90 22 1 page number of complete a separate block for each account owned separately this side can be copied as many times as necessary in order to provide information on all accounts. Annual reports of blocked property to be submitted on revised form tdf 90 22 50. The annual reports must be filed using the mandatory spreadsheet form td f 90 22 50.

The annual reports must be filed using the mandatory spreadsheet form td f 90 22 50. Failure to submit a required report by september 30 constitutes a violation of the reporting procedures and penalties regulations 31 c f r. If you have a financial interest in or signature authority over a foreign financial account including a bank account brokerage account mutual fund trust or other type of foreign financial account exceeding certain thresholds the bank secrecy act may require you to report the account yearly to the internal revenue service by filing electronically a. Once assets or funds are blocked they should be placed in a separate blocked account.

License applications must now be submitted on ofac s website or by mail using form td f 90 22 54. Prohibited transactions that are rejected must also be reported to ofac within 10 business days of the occurrence.